GRI 301-1, 301-2

Actions

In 2024 our Innovation team worked together closely with the product management, quality, supply chain, sales, and marketing teams to ensure the circular product and service innovation needed to achieve our circular ambition..

As a result, our portfolio welcomed new and optimised additions, such as:

Jute baxmatic bag with home-compostable strip, designed to prevent plastic waste (further optimised).

In addition to our ‘dry washing’ reconditioning service for big bags, we added ‘wet washing’ to our solutions portfolio, including big bags designed for washing, making reuse possible for a larger number of industries and products.

The Modified Atmosphere FIBC (MAP), which is an effective solution to prevent high-value products, such as infant food, nuts, seeds and pharmaceutical ingredients from going to waste before they even hit the shelves.

The FlexiBox: a durable and reusable parcel box that folds flat when not in use.

Additionally, we worked together with our customers to optimise product design to fit the circular economy.

Circular

Economy

(+10% compared to base year)

25% of our turnover comes from packaging that delivers the circular economy

Our goal to make our packaging circular by 2030, touches upon 6 out of 8 Sustainable Packaging Criteria

Packaging made out of renewable materials or recycled content materials, that is reusable if possible, and 100% recyclable (preferably closed-loop) or compostable.

Definition circular packaging

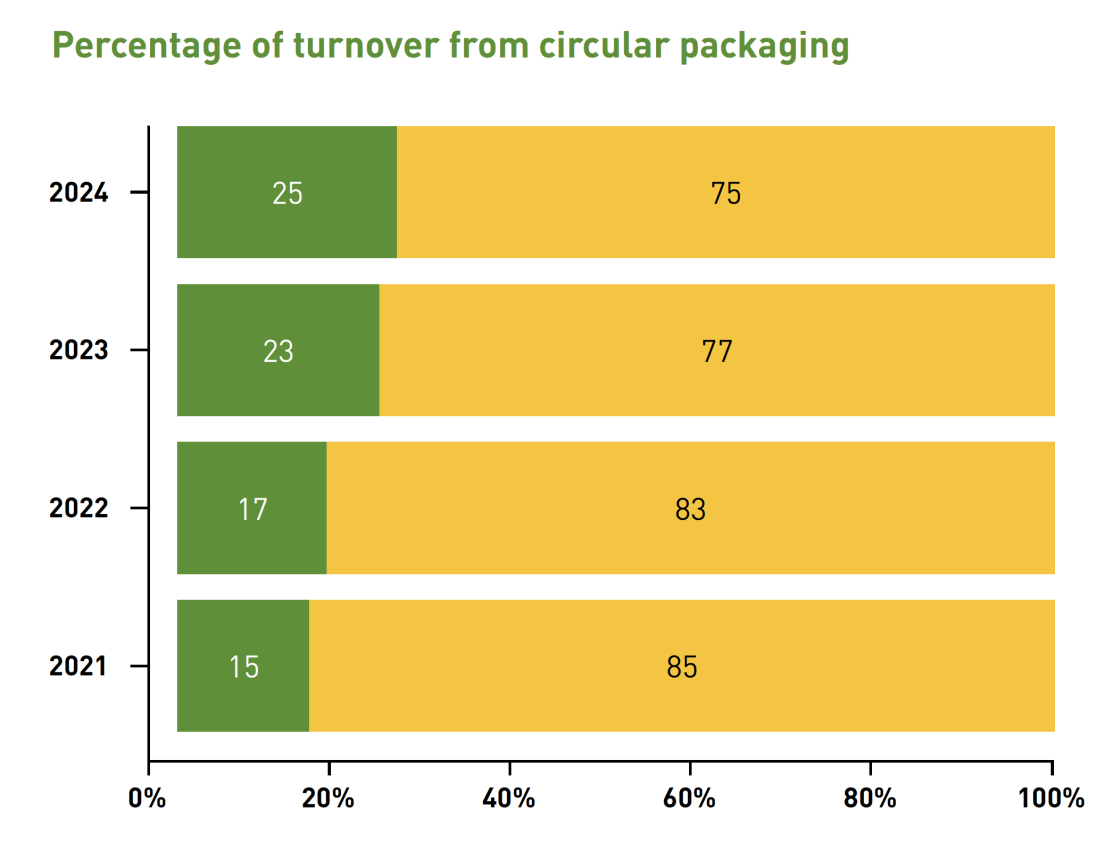

In base year 2021, 15% of turnover came from circular packaging.

Baseline

By 2030, at least 80% of our turnover comes from packaging that delivers the circular economy.

Goal

We continued our journey towards circular product innovation and services. Our product portfolio has been extended with more sustainable options, which have been introduced to our customers.

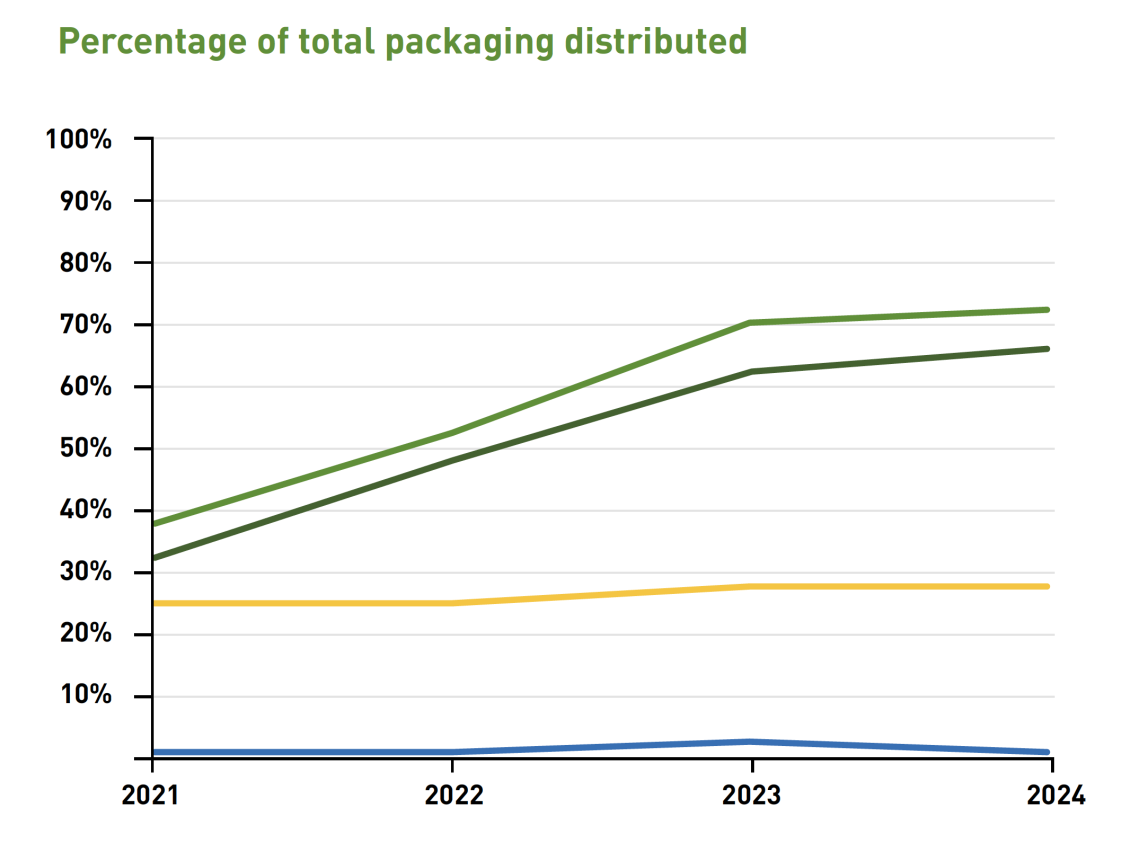

In 2024 circular products represented 27% of LC Packaging’s total turnover, and 25% of the turnover for the primary product categories included in the scope of our goal. This is a 2% increase compared to 2023 and 10% compared to base year 2021.

The graphic below presents an overview of the 2024 results and the progress made.

Please note: These results are based on calculations including LC Packaging’s primary product categories, representing 92.7% of the total kilos of materials used, and 93.1% of the company’s total turnover in 2024.

Progress on goal

Included in the scope of this goal are Royal LC Packaging’s (LC Packaging) main product categories: cardboard packaging, jute bags, FIBCs (big bags), woven PP bags and net bags. In 2024, these product categories represented 93.1% of LC Packaging’s total turnover.

Scope

It has proven to be challenging to increase the sales of plastics products made out of recycled content, as the price of virgin polypropylene (PP) and polyethylene (PE) is lower than the price of recycled PP and PE of the right quality. This makes it less attractive for companies to make a more sustainable packaging choice.

Additionally, it is challenging to increase the sales of technically reusable products and our actual reuse service. Since the 1990s, LC Packaging’s affiliate WorldBag has been a pioneer in the organised reuse of FIBCs. Over the last two years, we have made significant investments to expand our services, such as upgrades to air cleaning facilities and the addition of wet cleaning. We also anticipated the new EU Packaging & Packaging Waste Regulation (PPWR) would boost demand for reuse solutions, given its ambitious targets for 2030. Unfortunately, recent developments have shown market hesitation and rising costs. Given these challenges, we’ve had to make the difficult decision to pause our air-cleaning operation. We’re actively exploring alternative approaches and business models, such as wet cleaning technology and relocation options to restart the services for our customers.

For more detailed information on the materials used in our packaging, and the circularity of our packaging portfolio, please refer to our 2024 Sustainability Report.

Challenges

Circular products | 25% of turnover came from circular packaging, compared to 23% in 2022. A 10% increase compared to base year 2021 (15%). |

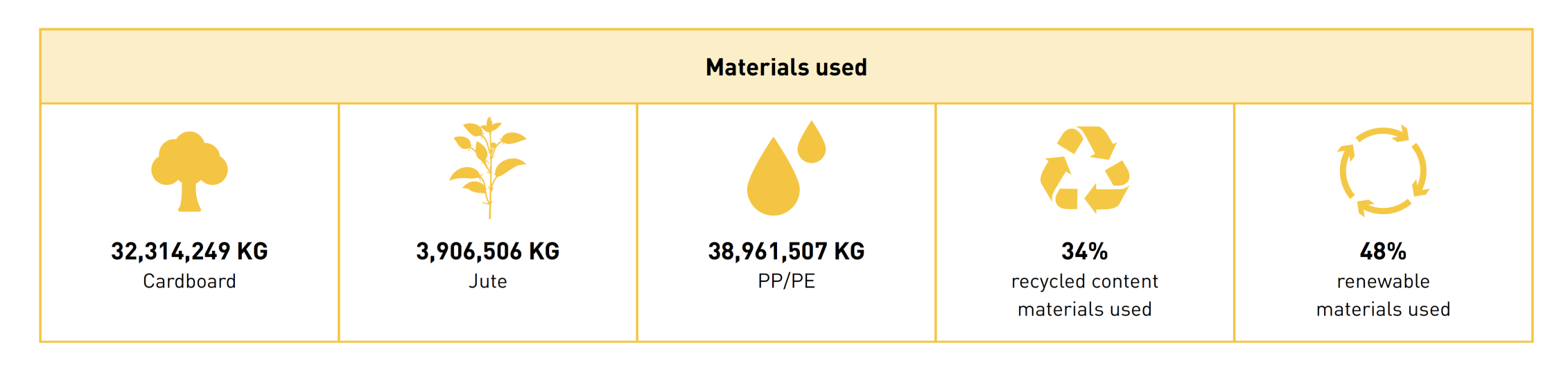

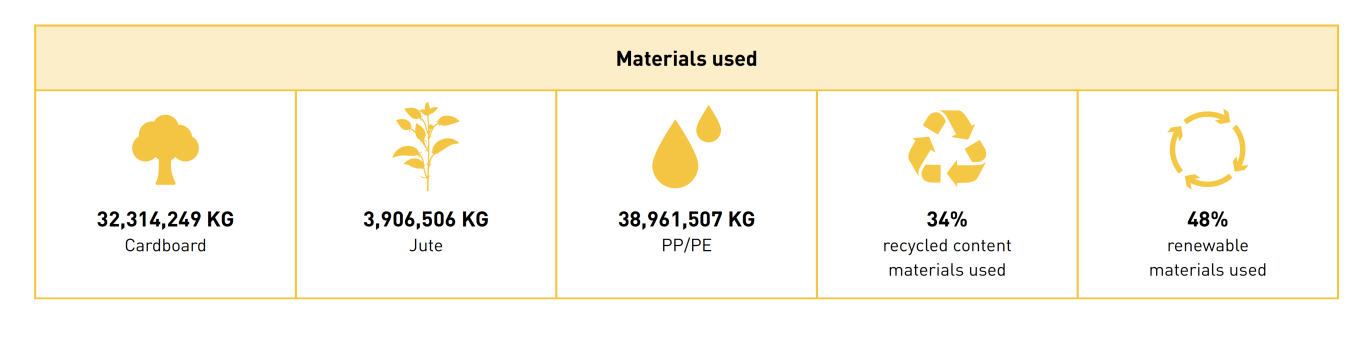

Kilos of materials used | 582 mln pcs of packaging were distributed, compared to 508 mln in 2023, resulting in more kilos of materials used: 75.1 mln kilos in 2024. 32 mln kilos of cardboard, 4 mln kilos of jute and 39 mln kilos of plastics. |

Renewable materials | 48% of the materials used were renewable, and 35% of turnover came from packaging made out of renewable materials. |

Recycled content materials | 34% of the materials used were recycled-content materials, and 35% of our distributed products included recycled-content materials. A 3% decrease compared to 2023, due to the inclusion of the products distributed by (formerly) Karl Weiterer, which included a large number of net bags, which do not contain recycled content. |

Reusable products | 4 mln pcs of packaging distributed in 2024 were categorised as ‘technically reusable’, of which 46% was actually reused through LC Packaging's WorldBag reuse programme (representing 11% of total turnover from technically reusable packaging) or at our customers’ sites. This is compared to almost 5 mln pcs distributed in 2023, of which 52% was actually reused. This decrease is mainly due to a decrease in distributed reusable postal bags. |

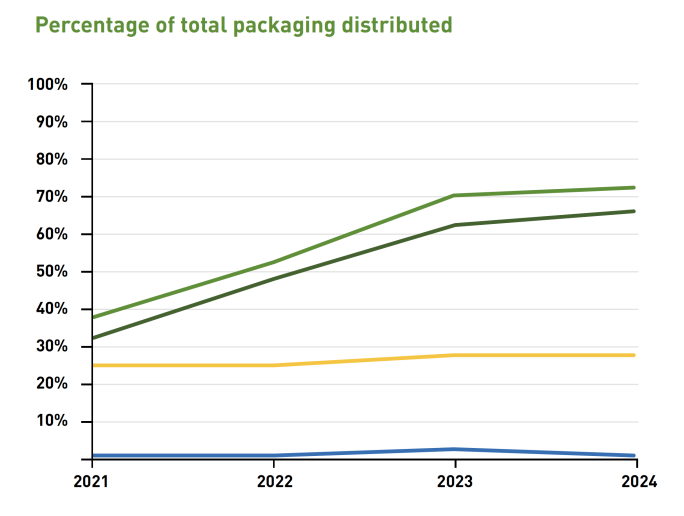

Recyclable products | 72% of distributed packaging was recyclable. An increase of 2% compared to 2023 and 33% compared to base year 2021. Recyclable packaging represented 69% of our turnover. The percentage of distributed closed-loop recyclable products increased to 66%, representing 53% of our turnover. |

Compostable products | 24% of turnover came from home-compostable packaging, compared to 23% in 2023, and 15% in 2021. As in 2023, 28% of distributed packaging in 2024 was home-compostable. |

LC Packaging aims to annually improve the availability and quality of data related to the material use and circular economy criteria. We are working on evolving definitions, as a result of having obtained more knowledge on the actual reusability, recyclability and compostability of many of our packaging products, and market developments.

A summary of the 2024 results:

Explanation

For more detailed information on the materials used in our packaging, and the circularity of our packaging portfolio, please refer to our 2024 sustainability report

2024 Sustainability Report

2024 Sustainability Report

01

01

Policies, codes, and commitments

02

Awareness and

implementation

03

Research and

development

04

Data and

reporting

Our updated Sustainable Consumption Policy was communicated and implemented.

Policies, codes, and commitments

For our additional production partners, the Code of Conduct for Production Partners was updated and distributed, including a commitment to contribute to the circular economy.

We obtained the QA-CER Certification and the AENOR certification for the use of recycled polypropylene (rPP) in big bags used for non-food applications, affirming adherence to stringent quality standards and qualifying LC Packaging as an approved rPP-PCR supplier.

Read more

Royal LC Packaging’s reuse service WorldBag again took on a proactive role in the New European Reuse Alliance (New ERA) as founding member, aiming to raise awareness among relevant EU and national policymakers to establish the required infrastructure, incentives and rules to accelerate the transition from single-use to reuse.

Read industry statement

All our key production partners have signed the dedicated Code of Conduct for Key Production Partners. This code includes a requested commitment to contribute to the circular economy ambition.

Next steps

As looking forward is even more important than looking back, below is a brief overview of actions we are planning to take next.

Ensure progress towards our goal is made, by further developing our product and services innovation approach.

Include remaining product categories in circular economy strategy and where needed, define product category targets and sales KPIs in order to boost circular product innovation and the sales of these products.

Establish new partnerships to ensure closed loops and the use of more sustainable materials.

To create the environmental business case for circular packaging, develop and introduce Carbon Footprint Calculators for additional product categories, such as net bags, jute bags, WPP bags, and cardboard and paper packaging.

Further improve data quality and availability, leading to more reliable data for circular economy reporting and decision making.

25% of our turnover comes from packaging that delivers the circular economy

GRI 301-1, 301-2

LC Packaging aims to annually improve the availability and quality of data related to the material use and circular economy criteria. We are working on evolving definitions, as a result of having obtained more knowledge on the actual reusability, recyclability and compostability of many of our packaging products, and market developments.

A summary of the 2024 results:

Circular

Economy

Our goal to make our packaging circular by 2030, touches upon 6 out of 8 Sustainable Packaging Criteria

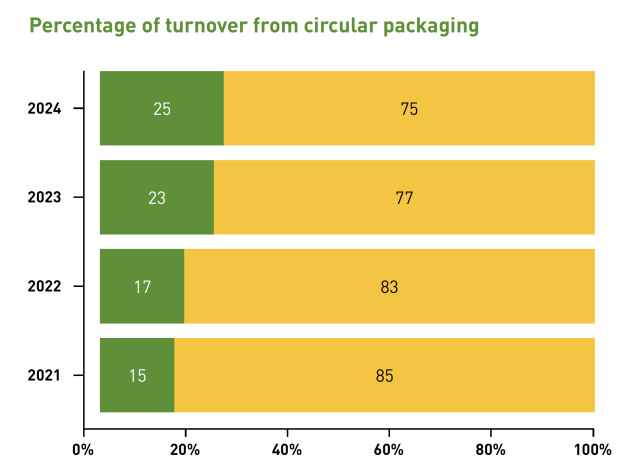

In base year 2021, 15% of turnover came from circular packaging.

Baseline

(+10% compared to base year)

By 2030, at least 80% of our turnover comes from packaging that delivers the circular economy.

Goal

Included in the scope of this goal are Royal LC Packaging’s (LC Packaging) main product categories: cardboard packaging, jute bags, FIBCs (big bags), woven PP bags and net bags. In 2024, these product categories represented 93.1% of LC Packaging’s total turnover.

Scope

Packaging made out of renewable materials or recycled content materials, that is reusable if possible, and 100% recyclable (preferably closed-loop) or compostable.

Definition circular packaging

We continued our journey towards circular product innovation and services. Our product portfolio has been extended with more sustainable options, which have been introduced to our customers.

In 2024 circular products represented 27% of LC Packaging’s total turnover, and 25% of the turnover for the primary product categories included in the scope of our goal. This is a 2% increase compared to 2023 and 10% compared to base year 2021.

The graphic below presents an overview of the 2024 results and the progress made.

Please note: These results are based on calculations including LC Packaging’s primary product categories, representing 92.7% of the total kilos of materials used, and 93.1% of the company’s total turnover in 2024.

Progress on goal

Circular products | 25% of turnover came from circular packaging, compared to 23% in 2022. A 10% increase compared to base year 2021 (15%). |

Kilos of materials used | 582 mln pcs of packaging were distributed, compared to 508 mln in 2023, resulting in more kilos of materials used: 75.1 mln kilos in 2024. 32 mln kilos of cardboard, 4 mln kilos of jute and 39 mln kilos of plastics. |

Renewable materials | 48% of the materials used were renewable, and 35% of turnover came from packaging made out of renewable materials. |

Recycled content materials | 34% of the materials used were recycled-content materials, and 35% of our distributed products included recycled-content materials. A 3% decrease compared to 2023, due to the inclusion of the products distributed by (formerly) Karl Weiterer, which included a large number of net bags, which do not contain recycled content. |

Reusable products | 4 mln pcs of packaging distributed in 2024 were categorised as ‘technically reusable’, of which 46% was actually reused through LC Packaging's WorldBag reuse programme (representing 11% of total turnover from technically reusable packaging) or at our customers’ sites. This is compared to almost 5 mln pcs distributed in 2023, of which 52% was actually reused. This decrease is mainly due to a decrease in distributed reusable postal bags. |

Recyclable products | 72% of distributed packaging was recyclable. An increase of 2% compared to 2023 and 33% compared to base year 2021. Recyclable packaging represented 69% of our turnover. The percentage of distributed closed-loop recyclable products increased to 66%, representing 53% of our turnover. |

Compostable products | 24% of turnover came from home-compostable packaging, compared to 23% in 2023, and 15% in 2021. As in 2023, 28% of distributed packaging in 2024 was home-compostable. |

Explanation

Actions

In 2024 our Innovation team worked together closely with the product management, quality, supply chain, sales, and marketing teams to ensure the circular product and service innovation needed to achieve our circular ambition..

As a result, our portfolio welcomed new and optimised additions, such as:

Jute baxmatic bag with home-compostable strip, designed to prevent plastic waste (further optimised).

In addition to our ‘dry washing’ reconditioning service for big bags, we added ‘wet washing’ to our solutions portfolio, including big bags designed for washing, making reuse possible for a larger number of industries and products.

The Modified Atmosphere FIBC (MAP), which is an effective solution to prevent high-value products, such as infant food, nuts, seeds and pharmaceutical ingredients from going to waste before they even hit the shelves.

The FlexiBox: a durable and reusable parcel box that folds flat when not in use.

Additionally, we worked together with our customers to optimise product design to fit the circular economy.

01

02

03

04

For our additional production partners, the Code of Conduct for Production Partners was updated and distributed, including a commitment to contribute to the circular economy.

All our key production partners have signed the dedicated Code of Conduct for Key Production Partners. This code includes a requested commitment to contribute to the circular economy ambition.

Our updated Sustainable Consumption Policy was communicated and implemented.

Royal LC Packaging’s reuse service WorldBag again took on a proactive role in the New European Reuse Alliance (New ERA) as founding member, aiming to raise awareness among relevant EU and national policymakers to establish the required infrastructure, incentives and rules to accelerate the transition from single-use to reuse.

Read industry statement

We obtained the QA-CER Certification and the AENOR certification for the use of recycled polypropylene (rPP) in big bags used for non-food applications, affirming adherence to stringent quality standards and qualifying LC Packaging as an approved rPP-PCR supplier.

Read more

Policies, codes,

and commitments

We shared an updated overview of and provided training on the relevant elements of the Packaging and Packaging Waste Regulation (PPWR) to inform our stakeholders about the developments around this regulation, and help our customers to prepare and align purchasing decisions.

Read more

An EPR and Plastic tax calculation tool was introduced to help our customers create a cost case for circular packaging and make more sustainable purchasing decisions.

Product category targets and sales KPIs have been defined and implemented throughout the organisation, in order to boost low-emission and circular product innovation, and the sales of these products.

In terms of governance, the steering committee, consisting of the full Board of Directors and the Head of Sustainability, met on a monthly basis with the Innovation team to make strategic decisions on circular product and infrastructure developments, among other things.

Following the workshops organised for employees in 2022, all new hires participate in a dedicated workshop on Royal LC Packaging’s 2030 Ambition, including our circular economy commitment.

A mandatory online training course on our circular economy commitment is available for all employees. On 31 December 2024, the course had a completion rate of 80.1%.

Awareness

and implementation

The innovation team conducted research on possible solutions to have our products meet circular economy criteria, such as feasibility research on the use and availability of biobased plastics, as an alternative for fossil based plastics.

Design scenarios were included in CO2e Product Lifecycle assessments conducted for our main product categories, in order to make strategic sustainable product development decisions.

As an active member of the EFIBCA/EuroJute Circular Economy Working group (CEW), Royal LC Packaging has actively contributed to a [Draft] Design for Recycling Industry Standard, creating the basis for the development of a circular economy for the FIBC (big bag) industry.

To create the environmental business case for circular packaging, Royal LC Packaging developed a Carbon Footprint Calculator for FIBCs together with our partner The Footprinters, showing the CO2e savings when using recycled materials or switching to reuse.

Read more

We collaborated with our partners in the value chain to establish closed-loop solutions, such as closed-loop recycling solutions for FIBCs, such as the closed-loop solution with RAFF Plastics.

New and optimised products and services were introduced in which circular economy criteria are included.

Research

and development

Our key production partners committed to sharing detailed material specifications, allowing us to assess our products according to circular economy criteria.

We have improved data quality and availability related to, among others, the circularity of our products, which has already resulted in more accurate reporting data on the weight of materials used and on circular economy criteria.

Data

and reporting

It has proven to be challenging to increase the sales of plastics products made out of recycled content, as the price of virgin polypropylene (PP) and polyethylene (PE) is lower than the price of recycled PP and PE of the right quality. This makes it less attractive for companies to make a more sustainable packaging choice.

Additionally, it is challenging to increase the sales of technically reusable products and our actual reuse service. Since the 1990s, LC Packaging’s affiliate WorldBag has been a pioneer in the organised reuse of FIBCs. Over the last two years, we have made significant investments to expand our services, such as upgrades to air cleaning facilities and the addition of wet cleaning. We also anticipated the new EU Packaging & Packaging Waste Regulation (PPWR) would boost demand for reuse solutions, given its ambitious targets for 2030. Unfortunately, recent developments have shown market hesitation and rising costs. Given these challenges, we’ve had to make the difficult decision to pause our air-cleaning operation. We’re actively exploring alternative approaches and business models, such as wet cleaning technology and relocation options to restart the services for our customers.

For more detailed information on the materials used in our packaging, and the circularity of our packaging portfolio, please refer to our 2024 Sustainability Report.

Challenges

Next steps

As looking forward is even more important than looking back, below is a brief overview of actions we are planning to take next.

Ensure progress towards our goal is made, by further developing our product and services innovation approach.

Include remaining product categories in circular economy strategy and where needed, define product category targets and sales KPIs in order to boost circular product innovation and the sales of these products.

Establish new partnerships to ensure closed loops and the use of more sustainable materials.

Further improve data quality and availability, leading to more reliable data for circular economy reporting and decision making.

For more detailed information on the materials used in our packaging, and the circularity of our packaging portfolio, please refer to our 2024 sustainability report

2024 Sustainability Report

2024 Sustainability Report